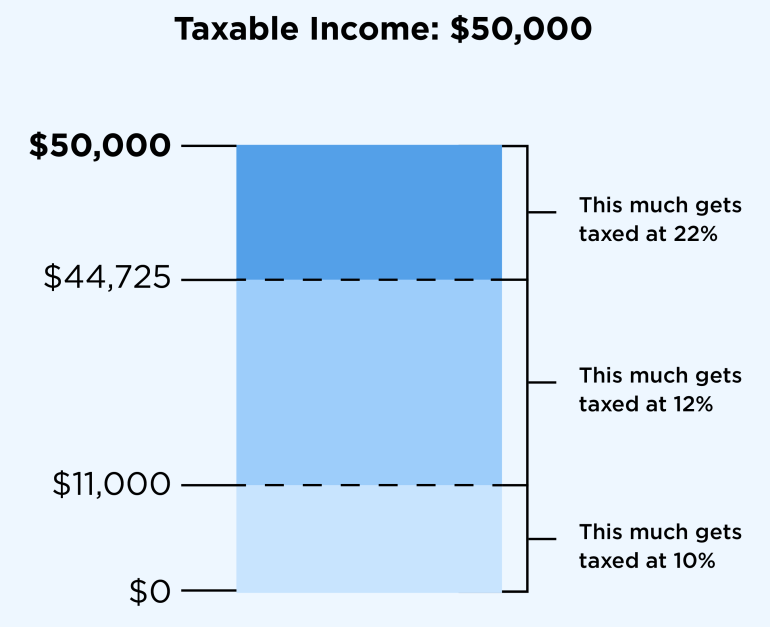

Tax Brackets 2024 Nerdwallet Template – There is a separate set of tax brackets and rates for long-term capital gains and qualified dividends. Investors who have taxable accounts—as opposed to tax-favored retirement accounts such as . The Internal Revenue Service (IRS) has unveiled its annual inflation adjustments for the 2024 tax year, featuring a slight uptick in income thresholds for each bracket compared to 2023. .

Tax Brackets 2024 Nerdwallet Template

Source : www.nerdwallet.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.nerdwallet.com

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.pinterest.com

Bonus Tax Rate: How Are Bonuses Taxed? NerdWallet

Source : www.nerdwallet.com

W 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com

California Income Tax 2023 2024: Rates, Who Pays NerdWallet

Source : www.nerdwallet.com

2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet

Source : www.pinterest.com

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

Tax Brackets 2024 Nerdwallet Template 2023 2024 Tax Brackets and Federal Income Tax Rates NerdWallet: Flipping the calendar from 2023 to 2024 will bring the child tax credit could be worth up to $2,000 per kid depending on your household income, according to NerdWallet. Of that, $1,600 . As your taxable income moves up this ladder, each layer gets taxed at progressively higher rates. A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. .